Office Hours

9:00 AM - 5:00 PM

Our Location

1827 Walden Office SQ. Suite 130, Schaumburg, IL, 60173

+18476877765

Our Services - Explore Insurance Options Below

Looking for the right insurance option in Cook County or Schaumburg? Whether it's for you, your family, or loved ones, you are in luck; with Thomas Conner, US Health Advisor, we have many to choose from.

US Health Advisor - Thomas Conner

Innovative Healthcare

Solutions

We offer efficient, effective healthcare solutions focused on patient satisfaction.

Leveraging the latest technologies, we provide high-quality care tailored to your needs, from preventive services in Schaumburg to chronic care in Elgin.

Our health insurance plans ensure comprehensive coverage, supporting your well-being with access to top providers like Cigna and UnitedHealthcare.

Whether managing a chronic condition or seeking preventive care, our solutions are built to meet your needs and ensure you receive the best possible care.

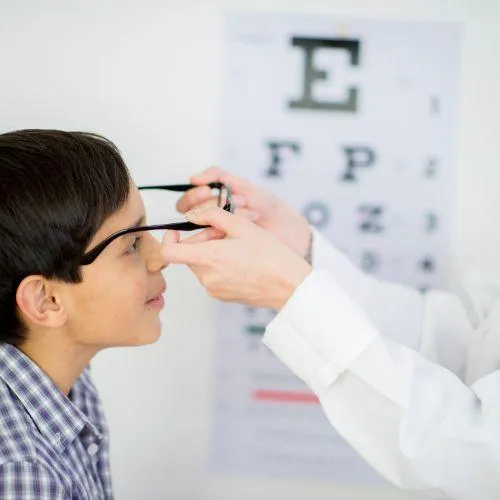

Dental/Vision, Life Insurance,

Accident/Disability Plans

Our insurance plans in Cook County provide comprehensive protection for you and your loved ones.

The Dental and Vision plans cover routine check-ups, cleanings, eye exams, glasses, and more, ensuring essential care for your oral and visual health.

Our health insurance includes both term and whole life policies, offering financial security with coverage for income replacement, mortgage protection, and final expenses.

Our Accident and Disability plans cover medical costs, hospital stays, and income replacement for unexpected injuries.

Access to a National PPO with

United Health Care

Our health insurance plans offer access to UnitedHealthcare’s national PPO network, providing you with a wide range of doctors, specialists, and hospitals across the U.S. For residents of Schaumburg and surrounding areas, this means flexibility to choose the providers that best meet your healthcare needs—whether for specialized local care or while traveling.

Our PPO plans cover preventive, chronic, and emergency services, ensuring high-quality care wherever you are.

Customizable to fit your needs and budget, our plans offer comprehensive options, from primary care to specialized treatments, so you can select the right providers for you and your family.

Personalized Customer Service Through Tom Conner and Team!

At Thomas Conner - US Health Advisor, we prioritize personalized customer service to meet your unique insurance needs. Tom Conner and our team are dedicated to offering attentive, tailored support, ensuring you get the right solutions for health, life, and other insurance products.

From policy questions to finding the best coverage, we’re here to assist promptly and effectively. Serving Schaumburg, Elgin, and surrounding areas, we provide expert guidance and ongoing policy reviews to keep your coverage aligned with your life’s changes.

Count on us for responsive, knowledgeable support every step of the way.

Innovative Healthcare Solutions

At Thomas Conner - US Health Advisor, we blend advanced technology with personalized care, giving you efficient, accessible healthcare coverage.

Our plans include everything from routine care to specialized services and offer flexibility through UnitedHealthcare’s national PPO network.

With access to top healthcare providers across the U.S., you’re covered wherever you are—whether seeking preventive care or managing chronic conditions.

Dental/Vision, Life Insurance, Accident/Disability

Our insurance plans cover a range of essential needs:

Dental & Vision: Routine check-ups, cleanings, exams, and eyewear.

Life Insurance: Flexible term and whole-life options to protect your family’s future.

Accident & Disability: Financial support during recovery from unexpected events. For businesses in Schaumburg and nearby areas, we also offer employee benefit packages that help you support and retain your team..

"Your Health, Our Priority"

From Medicare and business insurance to liability and auto coverage, we partner with leading providers like Cigna to offer reliable solutions tailored to you. Our dedicated team, led by Tom Conner, offers knowledgeable, personalized guidance to ensure you get the right coverage and support as your needs evolve.

Access to a National PPO with

United Health Care

With UnitedHealthcare’s PPO, you have the freedom to choose your providers nationwide, ensuring top-quality care wherever you need it.

Our flexible plans are designed to support you, from routine care to complex treatments, with options you can customize to fit your budget and needs.

Dedicated Support Staff

Tom Conner and our team offer personalized, expert assistance, making every interaction seamless and supportive.

Whether you’re looking to update a policy or need help finding the right plan, we’re here for you at every step—providing attentive, ongoing support to keep your coverage aligned with life’s changes.

Frequently Asked Questions

How much does health insurance cost in Illinois?

The cost of health insurance in Illinois varies based on several factors, including the type of plan, your age, and whether you qualify for any subsidies. On average, health insurance premiums can range from $300 to $600 per month for individual coverage. Family plans typically cost more, depending on the number of people covered and the level of coverage chosen.

Why is health insurance so expensive?

Health insurance can be costly due to various factors, including rising healthcare costs, the need for comprehensive coverage, and the inclusion of essential health benefits as mandated by law. The cost also depends on the type of insurance policy you choose, such as HMO, PPO, or high-deductible health plans.

Which health insurance is best in Illinois?

The best health insurance in Illinois depends on your specific needs, budget, and preferences. Some of the top providers include Blue Cross Blue Shield, Cigna, and State Farm Insurance. Each company offers a variety of plans with different levels of coverage, including options for individuals, families, and businesses.

What other types of insurance should I consider besides health insurance?

In addition to health insurance, it's important to consider other types of coverage to protect various aspects of your life with other businesses. These include:

Home Insurance: Home insurance protects your home and belongings from damage or loss due to events like fires, theft, or natural disasters. Auto Insurance: Provides coverage for damages or injuries resulting from car accidents.

Life Insurance: Offers financial security to your loved ones in the event of your death.

Liability Insurance: Covers legal costs and damages if you're found responsible for someone else's injuries or property damage.

Business Insurance: Protects your business assets, including liability coverage, property insurance, and employee benefits.

Our insurance agency offers a wide range of health insurance products, allowing you to bundle other policies for convenience and savings.

How can I get insurance quotes in Illinois?

Getting insurance quotes in Illinois is a straightforward process. You can start by contacting our insurance agency directly or using online tools to compare quotes from various providers.

How do I choose the right insurance company?

Choosing the right health insurance company involves considering several factors, such as the company's reputation, financial stability, customer service, and the range of products they offer. Look for a company that has a strong track record, positive customer reviews, and a variety of insurance solutions that match your needs.

What are the benefits of working with an insurance agent?

Working with an insurance agent provides several benefits, including personalized service, expert advice, and assistance with selecting the right coverage. An insurance agent can help you understand the complexities of different insurance policies, compare quotes from multiple providers, and ensure you get the best possible rates.

What should I consider when purchasing auto insurance in Illinois?

When purchasing auto insurance in Illinois, consider factors such as the level of coverage, policy limits, deductibles, and the reputation of the insurance company. Illinois law requires drivers to have liability insurance, but you may also want to consider additional coverage options like collision, comprehensive, and uninsured/underinsured motorist protection.

Can I bundle my insurance policies for better rates?

Yes, bundling your insurance policies—such as home insurance, auto insurance, and life insurance—can often lead to significant discounts. Many insurance companies offer multi-policy discounts to encourage customers to purchase multiple types of coverage from them.

What is liability insurance, and why do I need it?

Liability insurance provides protection against claims resulting from injuries or damage to other people or property. It covers legal costs, medical expenses, and other damages if you're found responsible for an accident. Liability insurance is crucial for both individuals and businesses, as it helps protect your assets in the event of a lawsuit.

© Copyright 2024, Thomas Conners, All Rights Reserved.